Mobile Banking Applications Electronic tools are revolutionary digital tools that have changed the way individuals and companies deal with financial and banking affairs. These applications provide direct and convenient access to bank accounts, investments, and other financial services through smart devices such as mobile phones and tablets.

Mobile Banking Applications offer many benefits that make it easier for users to manage their finances efficiently and safely. Here are some key benefits:

Convenience and accessibility: Mobile Banking Applications provide quick and convenient access to banking services at any time anywhere, which reduces the need to visit bank branches.

Save time and effort: Users can perform multiple transactions quickly and efficiently, such as transferring money, paying bills, and checking balances, without waiting in queues.

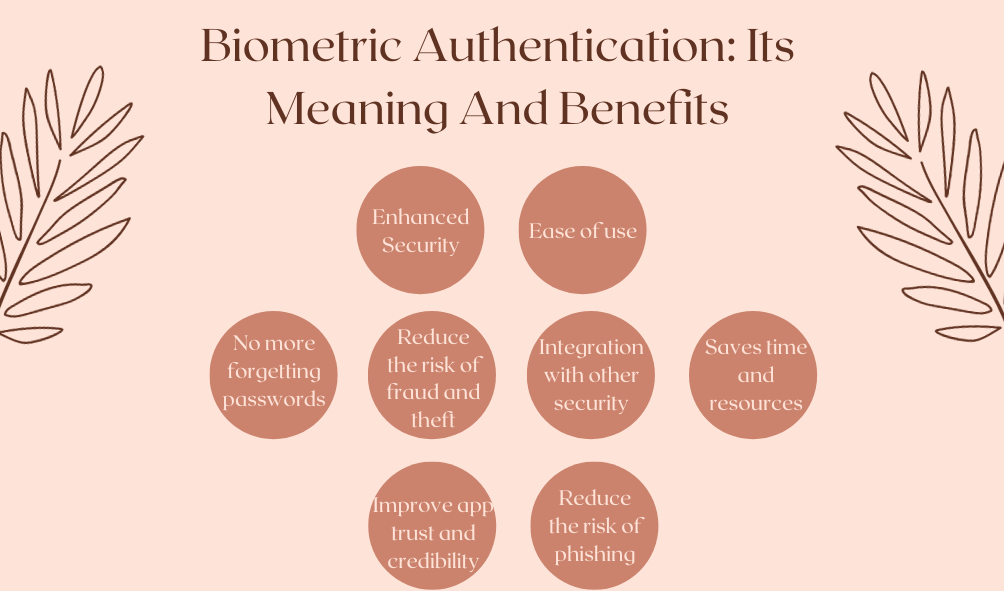

Enhancing security: banking applications Modern ones use advanced security technologies, such as encryption, two-factor authentication, and biometric authentication, to protect user data and transactions.

Instant personal finance management: These apps provide tools to track spending, manage a budget, and monitor financial accounts, which helps in improving financial awareness and making informed financial decisions.

Electronic payment and digital commerce: Facilitating online purchases and payments, which supports the growth of e-commerce.

Instant notifications and alerts: Banking apps send transaction notifications, warning messages, and alerts to keep your account safe and provide real-time updates.

Continuous updates and development: Banks regularly update their applications to add new features, improve security, and improve the user experience.

Support sustainability and reduce paper use: By reducing the need for paper transactions, banking apps contribute to environmental efforts and promote sustainability.

Integration with other financial services: It can be integrated with investment platforms, insurance, and other financial services to provide an integrated experience.

Future trends for Mobile Banking Applications are towards improving security, enhancing convenience, and integrating modern technologies to provide a more effective and personalized user experience. Here are some key trends:

Artificial Intelligence and Machine Learning: Artificial Intelligence will continue to be used in the development of banking applications, allowing the user experience to be improved by personalizing services, providing smart financial recommendations, and improving automated customer support.

Financial Technology (FinTech) and Digital Banks: The growth of digital banks and FinTech companies will drive greater innovation in banking products and services, increasing competitiveness in the banking sector.

Improved security and privacy: With increasing awareness of data security and privacy, banking applications are expected to adopt more advanced security technologies such as multi-factor authentication and blockchain technologies.

Integrating Blockchain Technologies: Using blockchain technology to enhance security and transparency in international banking transactions and payments.

Contactless Payments and Digital Wallets: Increased adoption of contactless payments and digital wallets to facilitate fast and secure transactions.

Integrated Banking: Integrating banking applications with other services such as healthcare, insurance, and e-commerce to provide comprehensive financial solutions.

Personal and Advisory Banking: Developing personal and advisory banking with the help of AI to provide personalized financial advice and guidance.

Improved user experience: Greater focus on UI and UX/UI design to make apps more user-friendly and attractive.

Concluding the discussion about Mobile Banking Applications, it can be said that these applications have revolutionized how we manage our finances. It has made it easier for consumers and businesses alike to access banking services in a more efficient, secure, and convenient way than ever before.

By incorporating advanced technology such as artificial intelligence, blockchain, and biometric authentication, Mobile Banking Applications continue to develop and improve the services provided to meet the changing needs of users.

With increasing reliance on digitization in all aspects of our lives, Banking Apps are expected to play a pivotal role in shaping the future of financial services. Innovations in this area will continue to open new horizons for improvements in efficiency, security, and customer experience, supporting progress towards a more inclusive and digitized financial management society.